Last analysis for Apple expected more upwards movement to a target at 470.5 before new lows. Movement below 419 invalidated the hourly wave count indicating an end to the correction earlier than expected, and the start of a third wave down.

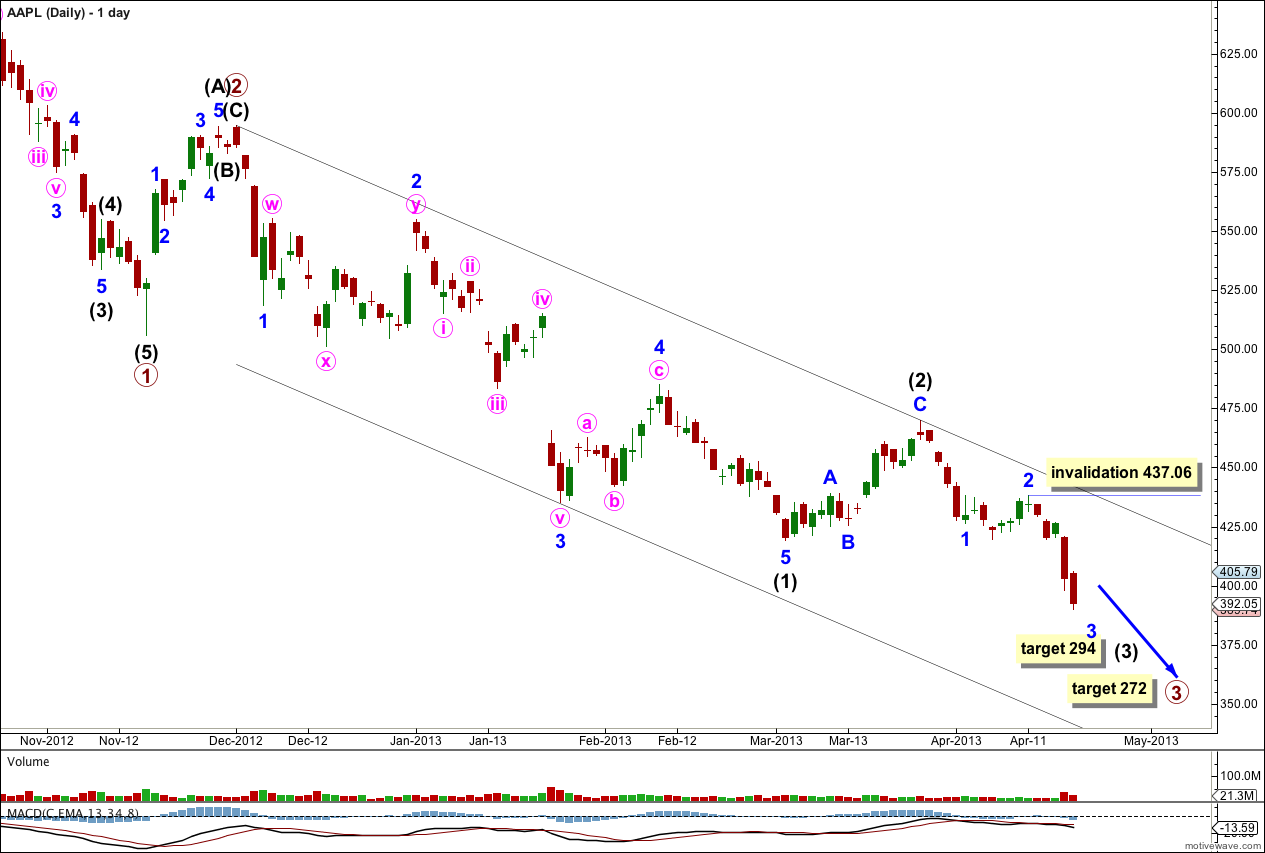

The daily chart is mostly the same. I can now calculate short and mid term targets to the downside.

Movement below 419 also invalidated the alternate daily wave count. We may now have more confidence in long term downwards targets.

Click on the charts below to enlarge.

This main wave count expects a five wave impulse for a cycle degree wave a is unfolding to the downside. Within the impulse primary waves 1 and 2 are complete. Primary wave 3 may be extending. Within primary wave 3 intermediate waves (1) and (2) are complete. Intermediate wave (3) has begun.

At 294 intermediate wave (3) would reach equality in length with intermediate wave (1).

At 272 primary wave 3 would reach 1.618 the length of primary wave 1. This long term target is months away.

Within intermediate wave (3) minor waves 1 and 2 may be complete. Within minor wave 3 no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement above 437.06.

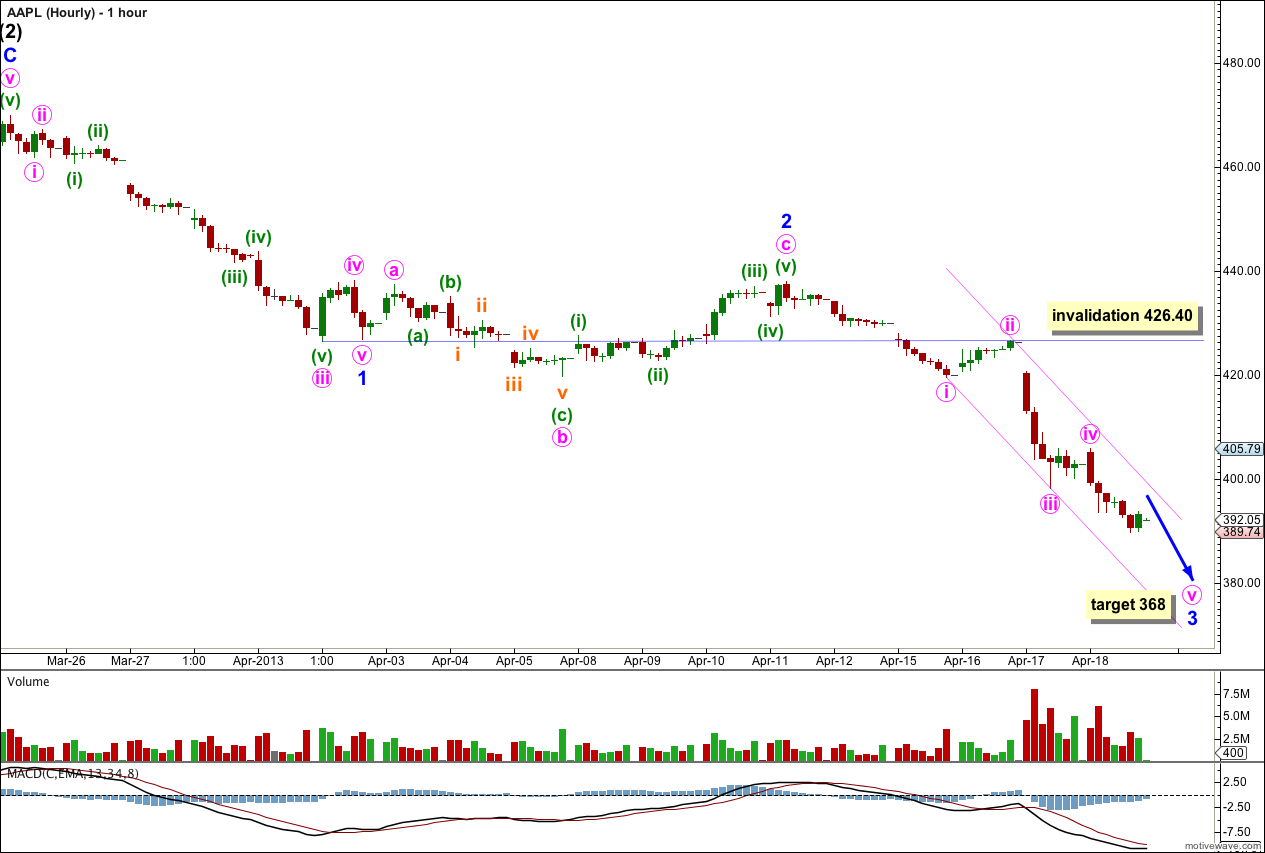

So far within this new downwards trend minor waves 1 and 2 look most likely to be complete.

Within minor wave 1 there are no Fibonacci ratios between minute waves i, iii and v.

Ratios within minute wave iii within minor wave 1 are: minuette wave (iii) has no Fibonacci ratio to minuette wave (i), and minuette wave (v) is 0.34 longer than 2.618 the length of minuette wave (i).

Within minor wave 2 expanded flat correction minute wave b is a 167% correction of minute wave a, and minute wave c is 1.2 longer than 1.618 the length of minute wave a.

Within minor wave 3 minute wave iii is 1.34 short of 1.618 the length of minute wave i. I would not expect to see a Fibonacci ratio between minute wave v and either of minute waves i or iii.

At 368 minor wave 3 would reach 1.618 the length of minor wave 1. This short term target should be met before the next analysis, or very close to that point.

When minor wave 3 is complete the following upwards correction for minor wave 4 may not move back into minor wave 1 price territory. This wave count is invalidated with movement above 426.40.