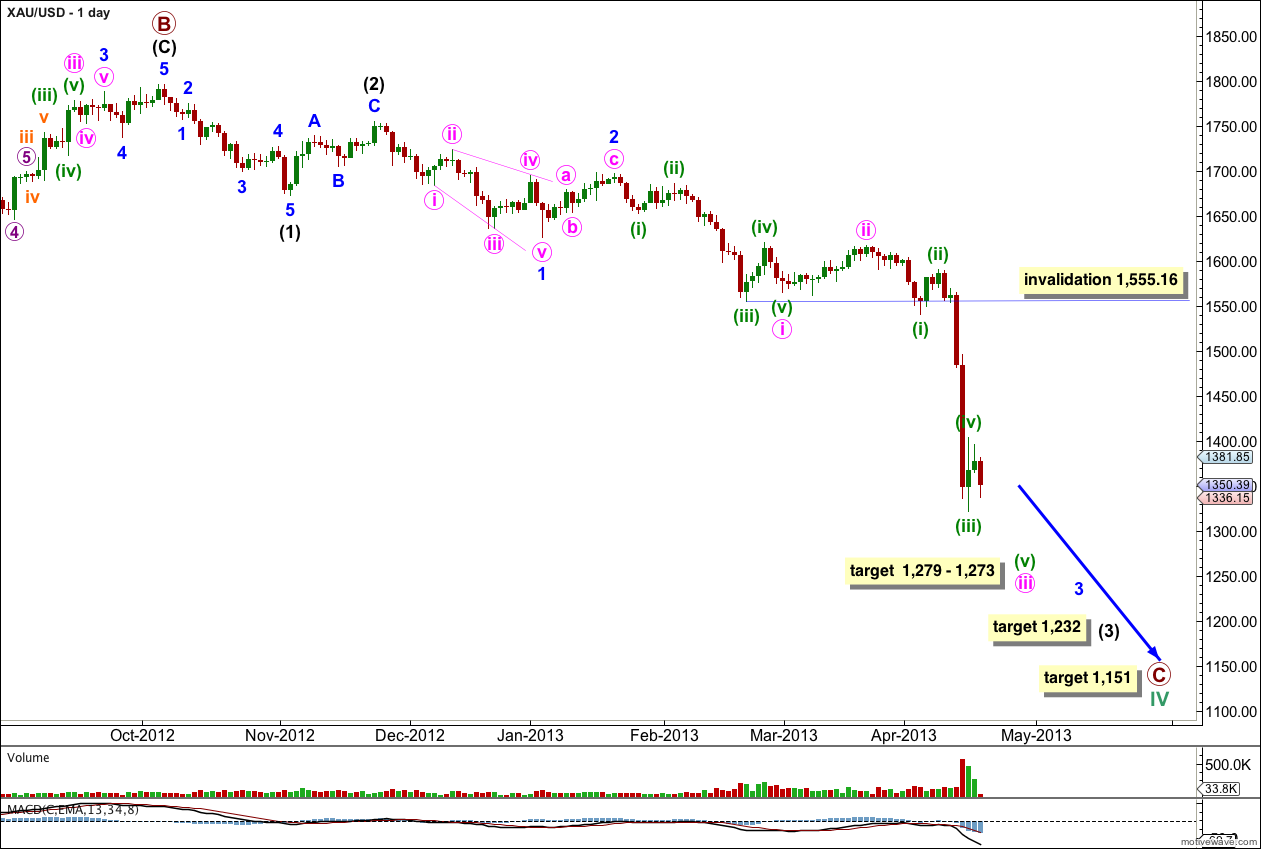

I am reverting back to my original gold wave count. Targets for that wave count have been breached so are recalculated.

This wave count expects that downwards movement is a third wave. The structure is incomplete. It needs further downwards to go. Along the way we shall see a series of fourth wave corrections.

Click on the charts below to enlarge.

This daily chart focuses on the new downwards trend of primary wave C.

Within primary wave C intermediate waves (1) and (2) are complete. Intermediate wave (3) is underway and may have just passed the middle of it.

Within intermediate wave (3) minor waves 1 and 2 are complete and minor wave 3 may have just passed the middle of it.

Within minor wave 3 minute waves i and ii are complete and minute wave iii is nearing its end.

At 1,279 minuette wave (v) within minute wave iii would reach 1.618 the length of minuette wave (i). Because there is no adequate Fibonacci ratio between minuette waves (i) and (iii) it is more likely we shall see a Fibonacci ratio between minuette wave (v) and either of (i) or (iii).

At 1,273 minute wave iii would reach 2.618 the length of minute wave i. This gives us a short term target zone of only $6 which should be met within the week.

At 1,232 intermediate wave (3) would reach 4.236 the length of intermediate wave (1).

At 1,151 primary wave C would reach 1.618 the length of primary wave A.

When minute wave iii is complete then the following correction for minute wave iv may not move back into minute wave i price territory. This wave count is invalidated with movement above 1,555.16.

This structure shows movement within minute wave iii. We may draw a parallel channel about this downwards movement. Draw the first trend line from the lows of minuette wave (i) (just off to the left of the chart, you see it on the daily chart) to minuette wave (iii). Place a parallel copy on the high of micro wave 2 within minuette wave (iii) to contain all movement.

Minuette wave (iv) looks like it may be over as a single zigzag correction ending midway within the channel. I would expect minuette wave (v) to end either midway within the channel, or to find support about the lower edge.

Without a new low and a clear new five down on the hourly chart we must accept the possibility that minuette wave (iv) may not be over and may continue further sideways as a flat or double. If it does it may not move into minuette wave (i) price territory. This wave count is invalidated with movement above 1,540.24.