The main wave count on last analysis expected more upwards movement from Oil towards a short to mid term target at 94.3 to 94.84. Price did continue higher to reach 2.89 above the target zone at 97.73, remaining below the invalidation point which is very close by now at 98.24.

The wave count remains the same. The correction must now be over; there is little room left for upwards movement that a third wave downwards should begin.

Click on the charts below to enlarge.

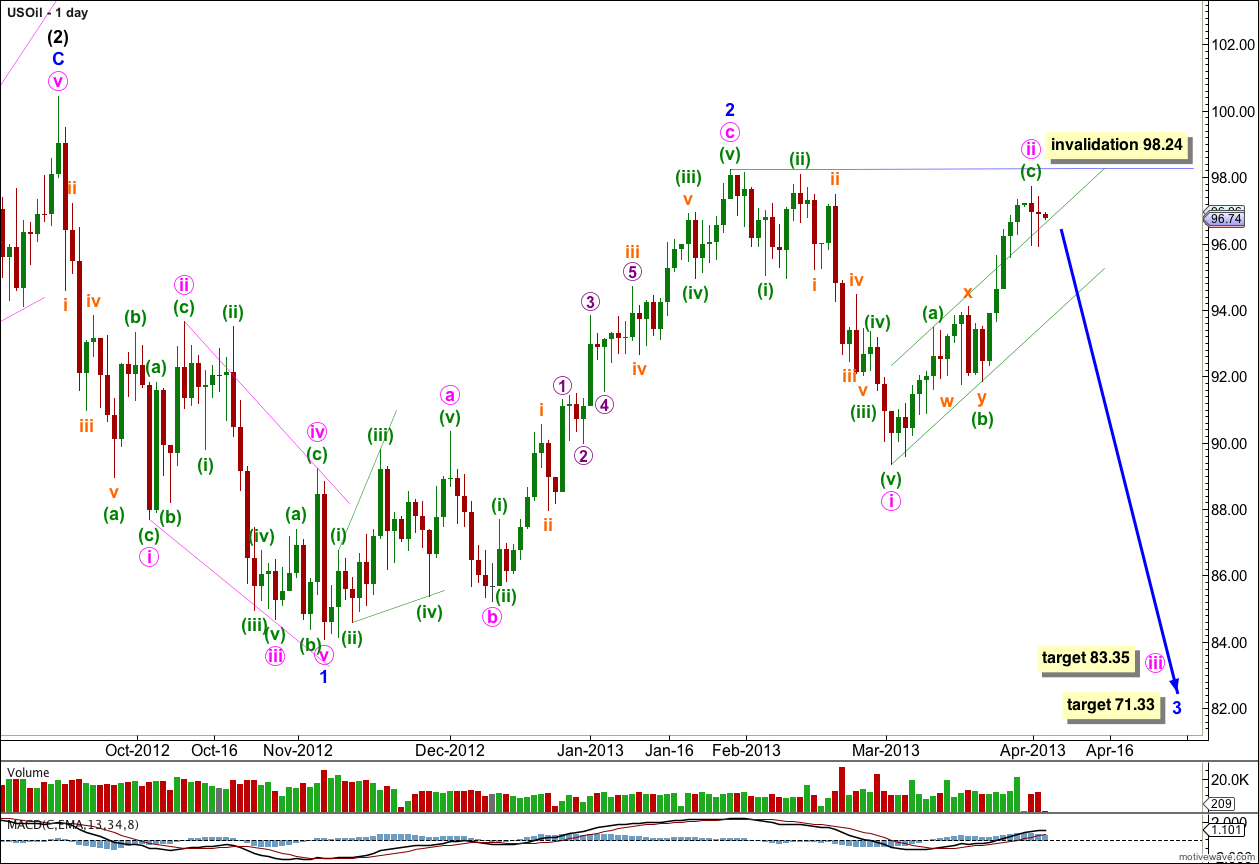

This wave count sees US Oil in a third wave downwards at intermediate degree, within a primary wave C down.

Within intermediate wave (3) minor waves 1 and 2 are complete.

Minor wave 3 must make a new low below the end of minor wave 1 at 84.07.

At 71.33 minor wave 3 would reach 1.618 the length of minor wave 1.

Draw a parallel channel around the correction of minute wave ii. Draw the first trend line from the start of minuette wave (a) to the end of minuette wave (b), then place a parallel copy upon the high of minuette wave (a). Often C waves overshoot such channels, as is the case here. When the channel is clearly breached by downwards movement we shall have trend channel confirmation that minute wave ii is over and minute wave iii is underway.

Within minute wave ii there is no Fibonacci ratio between minuette waves (a) and (c).

If it continues any higher minute wave ii may not move beyond the start of minute wave i. This wave count is invalidated with movement above 98.24.

Minute wave ii subdivides as a complete zigzag.

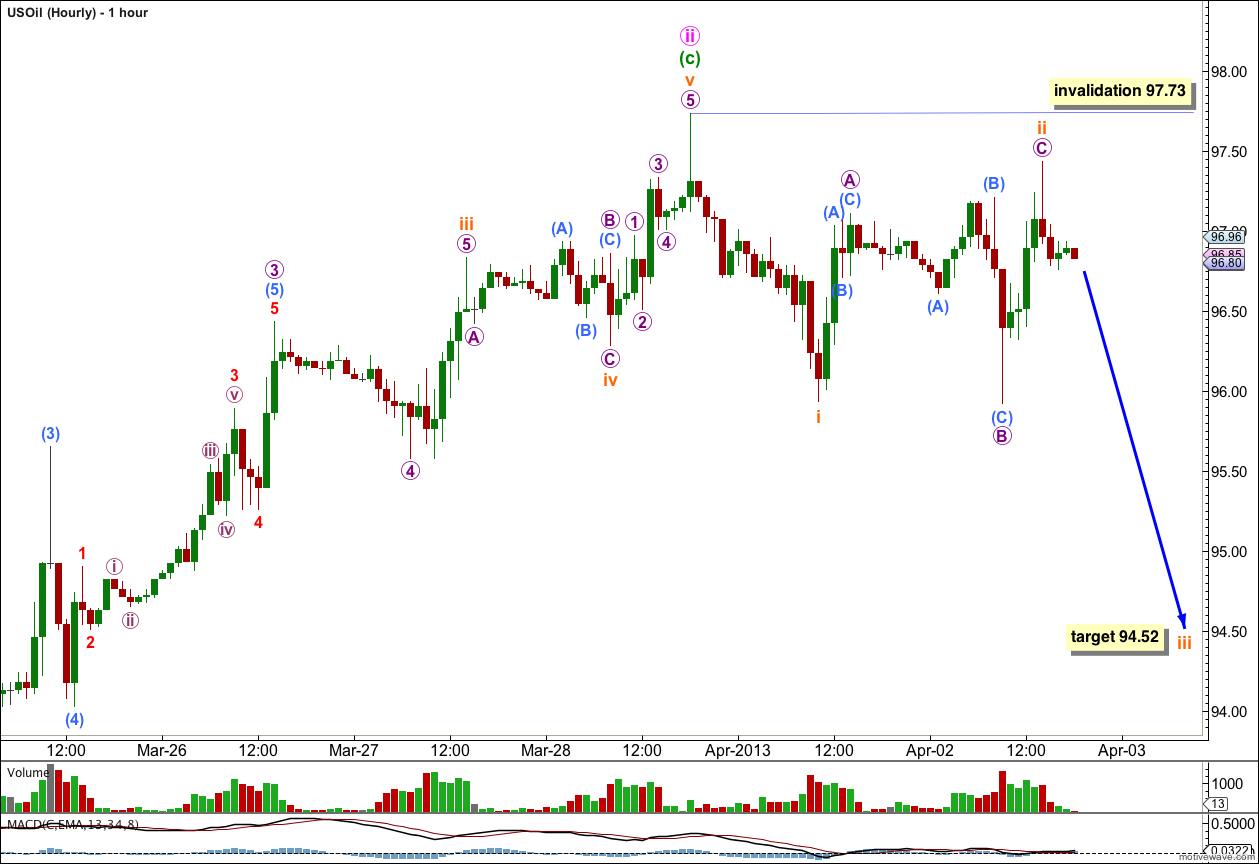

Downwards movement labeled subminuette wave i downwards is ambiguous. On the five minute chart there is so much overlapping within this movement it could be seen as either a three or a five. This wave count sees it as a five.

On the five minute chart subdivisions within subminuette wave ii are clear. Micro wave A is a three, as is micro wave B, and micro wave C can only be seen as a five. This structure is a regular flat correction; micro wave B is a 101% correction of micro wave A, and micro wave C has no Fibonacci ratio to micro wave A ending a little beyond the end of micro wave A.

Within minuette wave (c) there are no Fibonacci ratios between subminuette waves i, iii and v.

Within subminuette wave iii micro wave 3 is 0.38 short of 4.236 the length of micro wave 1, and micro wave 5 has no Fibonacci ratio to either of micro waves 1 or 3.

Within micro wave 3 submicro wave (3) has no Fibonacci ratio to submicro wave (1), and submicro wave (5) is 0.20 longer than 1.618 the length of submicro wave (1).

At 94.52 subminuette wave iii would reach 1.618 the length of subminuette wave i.

This wave count expects to see downwards movement which must make a new low below the end of subminuette wave i at 95.93, and which should show an increase in downwards momentum.

If subminuette wave ii moves any higher it may not move beyond the start of subminuette wave i. This wave count is invalidated with movement above 97.73.