Last week’s analysis expected the week to start with some downwards movement to a target at 14,397. The week did start with price moving lower to reach down to 14.91 points below the target.

Price continued the week in sideways movement in an ever decreasing range, indicating a possible triangle. If the triangle remains valid we shall have a high probability movement next in a sharp thrust out of the triangle, in the same direction of entry.

Click on the charts below to enlarge.

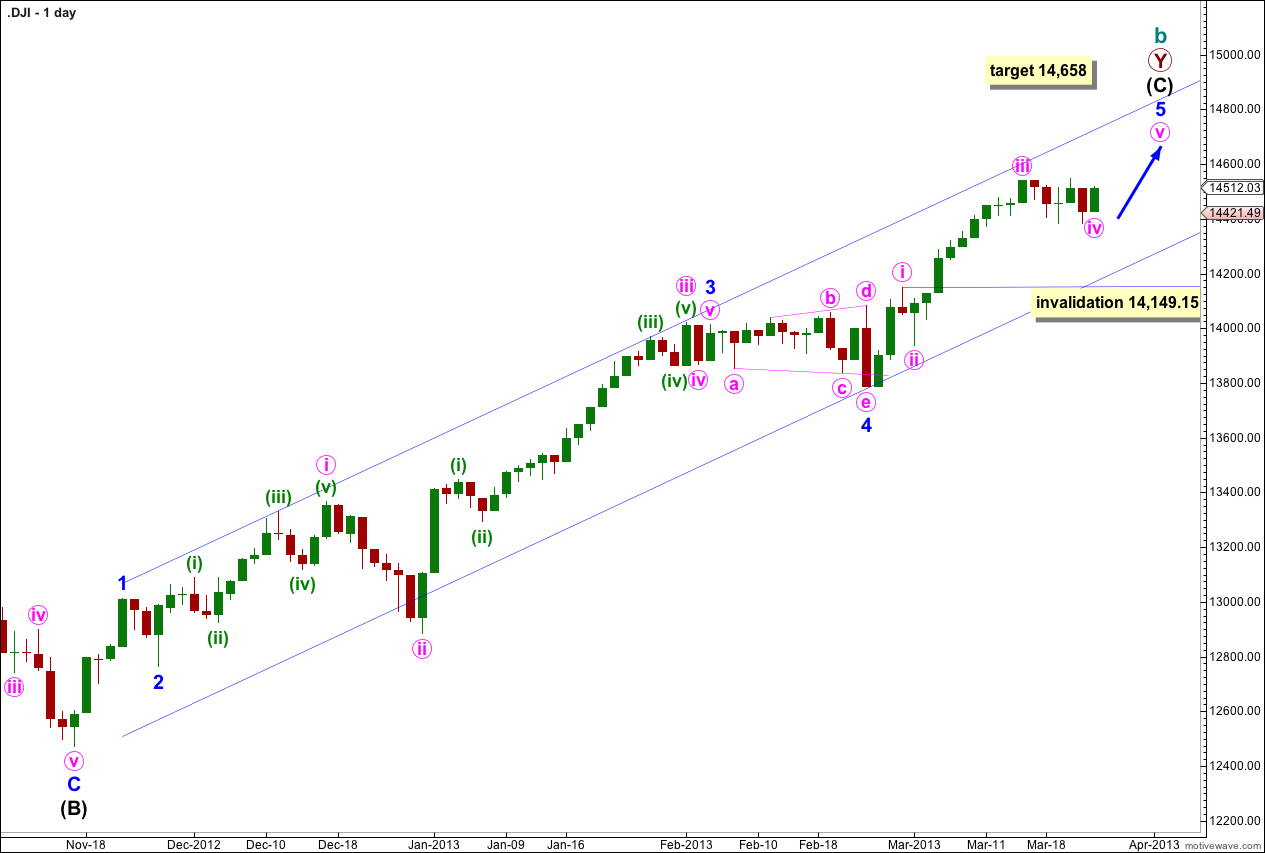

The daily chart shows the structure of intermediate wave (C) within the second zigzag of primary wave Y.

Within intermediate wave (C) minor wave 3 has no Fibonacci ratio to minor wave 1. It is more likely then that minor wave 5 will exhibit a Fibonacci ratio to either of minor waves 1 or 3. At 14,658 minor wave 5 would reach 1.618 the length of minor wave 1.

Within minor wave 5 minute waves i, ii and iii are likely to be complete. Minute wave iii was just 10.89 points longer than 1.618 the length of minute wave i.

Minute wave iv is unlikely to be complete. It may last another one or two sessions. Minute wave iv may not move into minute wave i price territory. This wave count is invalidated with movement below 14,149.15.

I have drawn the parallel channel first with a trend line from the highs of minor waves 1 to 3 and pushed this line out to sit on the high of minute wave iii within minor wave 3. A parallel channel is placed upon the low of minor wave 4. Price may remain contained within this channel while the trend remains upwards. When this channel is clearly breached with downwards movement we shall have an early indication of a possible trend change.

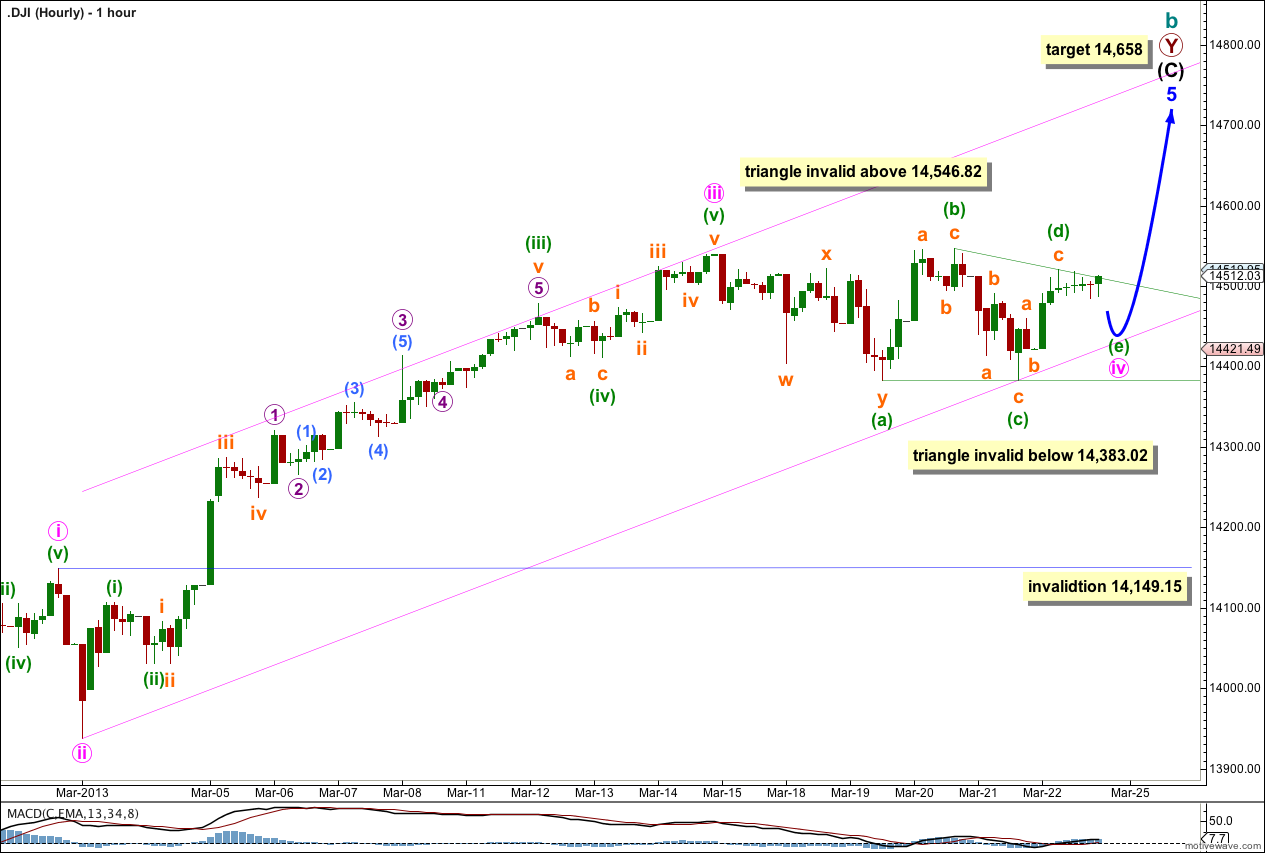

Minute wave iv looks like a contracting triangle.

One of the five subwaves of a triangle should be longer lasting and more complicated, a zigzag multiple. Minuette wave (a) fits this as a double zigzag.

Minuette waves (b), (c) and (d) all subdivide nicely as zigzags.

This triangle would be contracting because minuette wave (c) ends before the end of minuette wave (a). If minuette wave (d) moves higher it may not move beyond the end of minuette wave (b) at 14,546.82. If price moves above this point before minuette wave (e) downwards completes the triangle then the triangle would be invalid.

Within the contracting triangle minuette wave (e) may not move beyond the end of minuette wave (c) below 14,383.02. If price moves below this point the triangle is invalid and minute wave iv may be a double combination.

If the triangle remains valid then there is a high probability that price will move in a sharp upwards thrust out of the triangle. This thrust may be about 157 points in length if it is equal with the widest part of the triangle.

Minute wave iv may not move into minute wave i price territory. This wave count is invalidated with movement below 14,149.15.