Last week’s analysis had a target of 14,493 to 14,528. Price reached to 11.29 points above the target zone during the week.

I have adjusted the analysis at intermediate degree to be more in line with the S&P 500. This alters targets. The monthly wave count will be covered again this week to explain the change to the wave count.

Click on the charts below to enlarge.

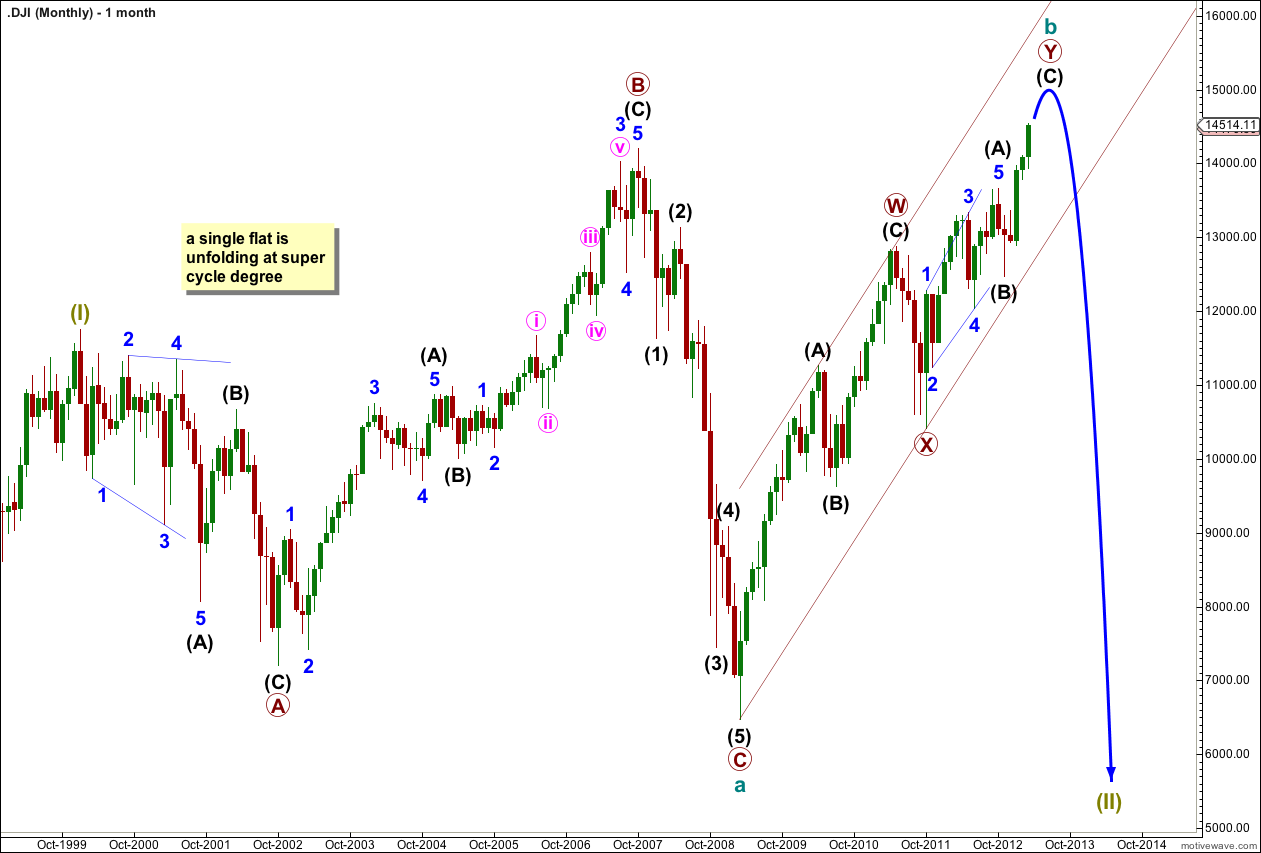

Main Monthly Wave Count.

Within the single flat correction for super cycle wave (II) cycle wave a is a three wave structure, an expanded flat correction. Within it primary wave B is a 154% correction of primary wave A, and primary wave C is 362 points longer than 1.618 the length of primary wave A (a 4.7% variation which is acceptable).

Cycle wave b passed 105% the length of cycle wave a at 12,014 so the structure at super cycle degree is most likely to be an expanded flat. We would expect cycle wave c to be 1.618 the length of cycle wave a, about 8,544 points in length.

Cycle wave b is an incomplete double zigzag structure. The second zigzag, primary wave Y is incomplete. Within primary wave Y intermediate wave (A) may have been an imperfect leading diagonal. Intermediate wave (C) passed 0.618 the length with intermediate wave (A) at 14,484 and the structure is incomplete. Intermediate waves (A) and (C) may not exhibit a Fibonacci ratio.

We may draw a parallel channel about cycle wave b. When this channel is clearly breached by downwards movement then we shall have trend channel confirmation of a trend change at cycle wave degree. At that stage we may have a lot of confidence that price is in a new downwards trend extremely likely to make a new low below 6,469.95 to avoid a truncation and a rare running flat.

The Dow exhibits very few Fibonacci time relationships, unlike the S&P 500. It is not a useful exercise to try and predict an ending date using Fibonacci durations for the Dow.

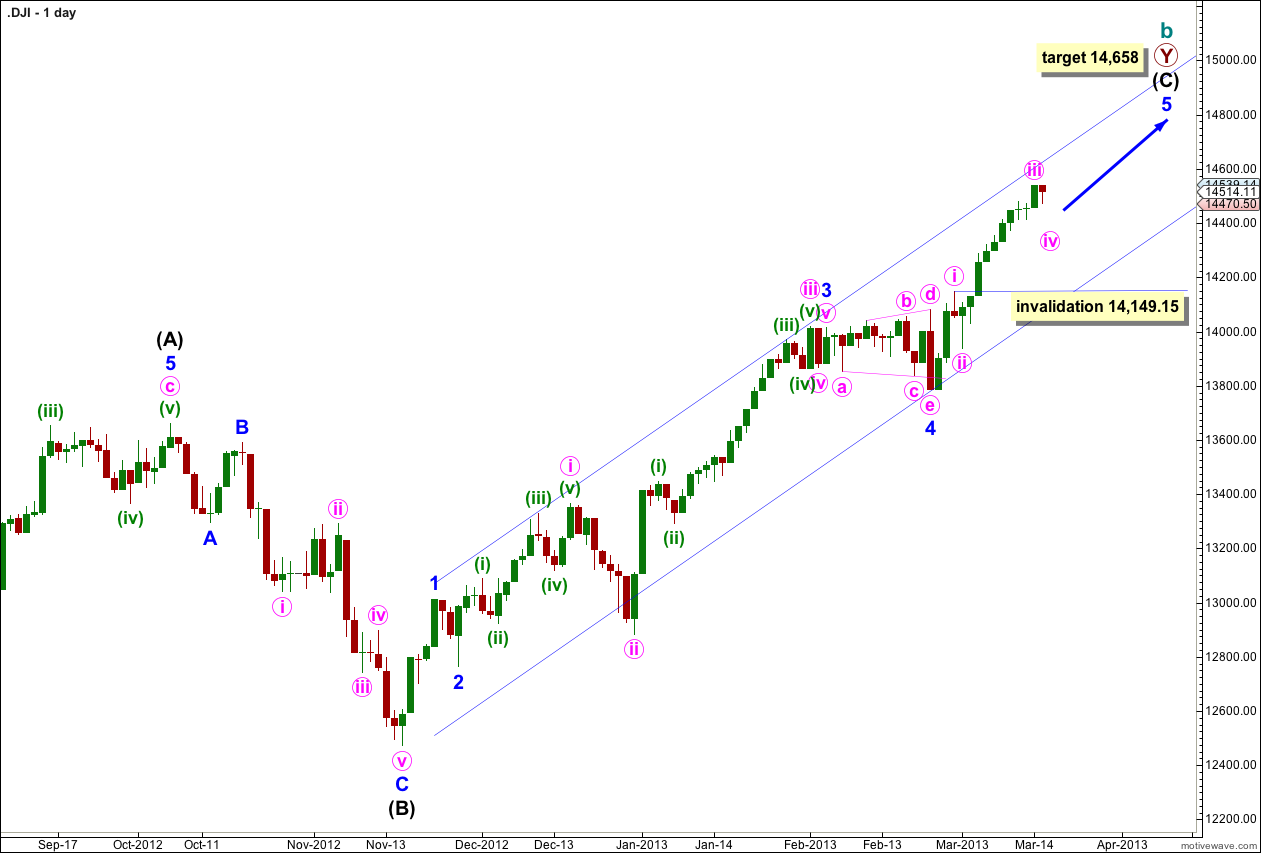

The daily chart shows the structure of intermediate wave (C) within the second zigzag of primary wave Y.

Within intermediate wave (C) minor wave 3 has no Fibonacci ratio to minor wave 1. It is more likely then that minor wave 5 will exhibit a Fibonacci ratio to either of minor waves 1 or 3. At 14,658 minor wave 5 would reach 1.618 the length of minor wave 1.

Within minor wave 5 minute waves i, ii and iii are likely to be complete. Minute wave iii was just 10.89 points longer than 1.618 the length of minute wave i.

Minute wave iv is unlikely to be complete. It may last another one or two sessions. Minute wave iv may not move into minute wave i price territory. This wave count is invalidated with movement below 14,149.15.

I have drawn the parallel channel first with a trend line from the highs of minor waves 1 to 3 and pushed this line out to sit on the high of minute wave iii within minor wave 3. A parallel channel is placed upon the low of minor wave 4. Price may remain contained within this channel while the trend remains upwards. When this channel is clearly breached with downwards movement we shall have an early indication of a possible trend change.

This hourly wave count shows the structure within minor wave 5 so far. The strongest momentum is within minute wave iii.

Within minute wave iv minuette wave (a) would most likely be complete. Minuette wave (b) may or may not be complete; it may move higher. Minuette wave (a) on the five minute chart looks most like a three wave structure and so minuette wave (b) may make a new high if minute wave iv is a flat correction. There can be no upper invalidation point for this correction.

If minute wave iv is a flat correction then minuette wave (b) should reach up to 14,532.41 to be 90% the length of minuette wave (a).

If minute wave iv is a double zigzag or double combination then upwards movement to 90% the length of the first corrective structure is not required.

At 14,397 minute wave iv would reach to the 0.236 Fibonacci ratio of minute wave iii.

If minute wave iv is a flat or double and a shallow correction of minute wave iii then it will exhibit perfect alternation with the deep zigzag structure of minute wave ii.

Minute wave iv may not move into minute wave i price territory. This wave count is invalidated at minute wave degree with movement below 14,149.15.