Last analysis expected price to move lower with an increase in momentum. This is not what has happened. Price moved higher past the first invalidation point on the hourly chart, but has remained below the second invalidation point and within the parallel channel on the daily chart.

The wave count is mostly the same. I am still expecting that an increase in downwards momentum with new lows is likely over the next few days for Apple.

Click on the charts below to enlarge.

This main wave count expects a five wave impulse for a cycle degree wave a is unfolding to the downside. Within the impulse price is within a third wave at primary degree. The strongest part of downwards movement is yet to unfold.

At 365 minor wave 3 would reach equality with minor wave 1. While minor wave 3 is in progress no second wave correction may move beyond the start of its first wave. In the short term this daily wave count is invalidated at minor degree with movement above 484.94.

At 356 intermediate wave (3) would reach 2.618 the length of intermediate wave (1).

At 272 primary wave 3 would reach 1.618 the length of primary wave 1. Thereafter, primary wave 4 should last a couple of weeks to a month or so and may not move back into primary wave 1 price territory. This wave count is invalidated at that stage with movement above 505.75. This is the price point which differentiates this main wave count from the alternate daily chart below.

At this stage upwards movement for a small correction may have found some resistance about the upper edge of this best fit parallel channel.

Within minor wave 3 minute waves i and ii may be complete. Minute wave iii may have just begun.

Within minute wave iii minuette wave (i) is complete. Minuette wave (ii) extended further sideways and higher over the last few days.

Minuette wave (ii) is subdividing into a double zigzag. It is now over 50% the length of minuette wave (i) so is relatively deep, and may end about here close to the 0.618 Fibonacci ratio of minuette wave (i) at 439.67.

At 384.9 minuette wave (iii) would reach 1.618 the length of minuette wave (i).

Thereafter, minuette wave (iv) should move price sideways in a small correction.

At 375 minute wave iii would reach 1.618 the length of minute wave i.

Minuette wave (ii) may not move beyond the start of minuette wave (i). This wave count is invalidated at minuette degree with movement above 452.44.

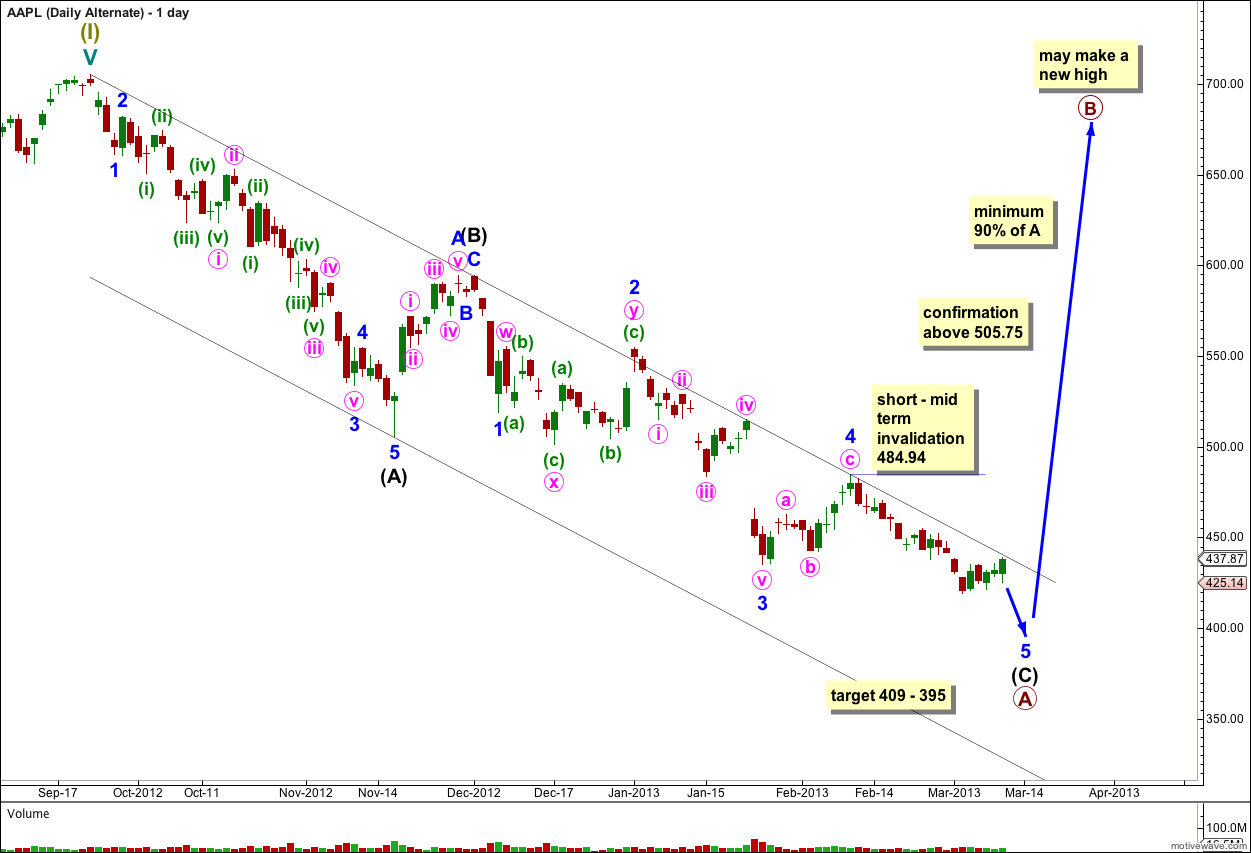

Alternate Daily Wave Count.

If momentum downwards fails to increase then this alternate would be a good explanation.

If cycle wave a is unfolding as a flat then primary wave A within it may be a zigzag.

At 409 minor wave 5 would reach equality in length with minor wave 1.

At 395 intermediate wave (C) would reach equality in length with intermediate wave (A).

When primary wave A is complete then primary wave B must reach at least 90% the length of primary wave A, and may make a new high. At that stage if price moves above 505.75 the main wave count above would be invalidated and this alternate would be confirmed. If that happens then we will know that price must continue to rise to the point where primary wave B equals 90% of primary wave A, at minimum.