Last analysis expected price to move higher during Monday’s session which is exactly what has happened.

The wave count is the same.

Click on the charts below to enlarge.

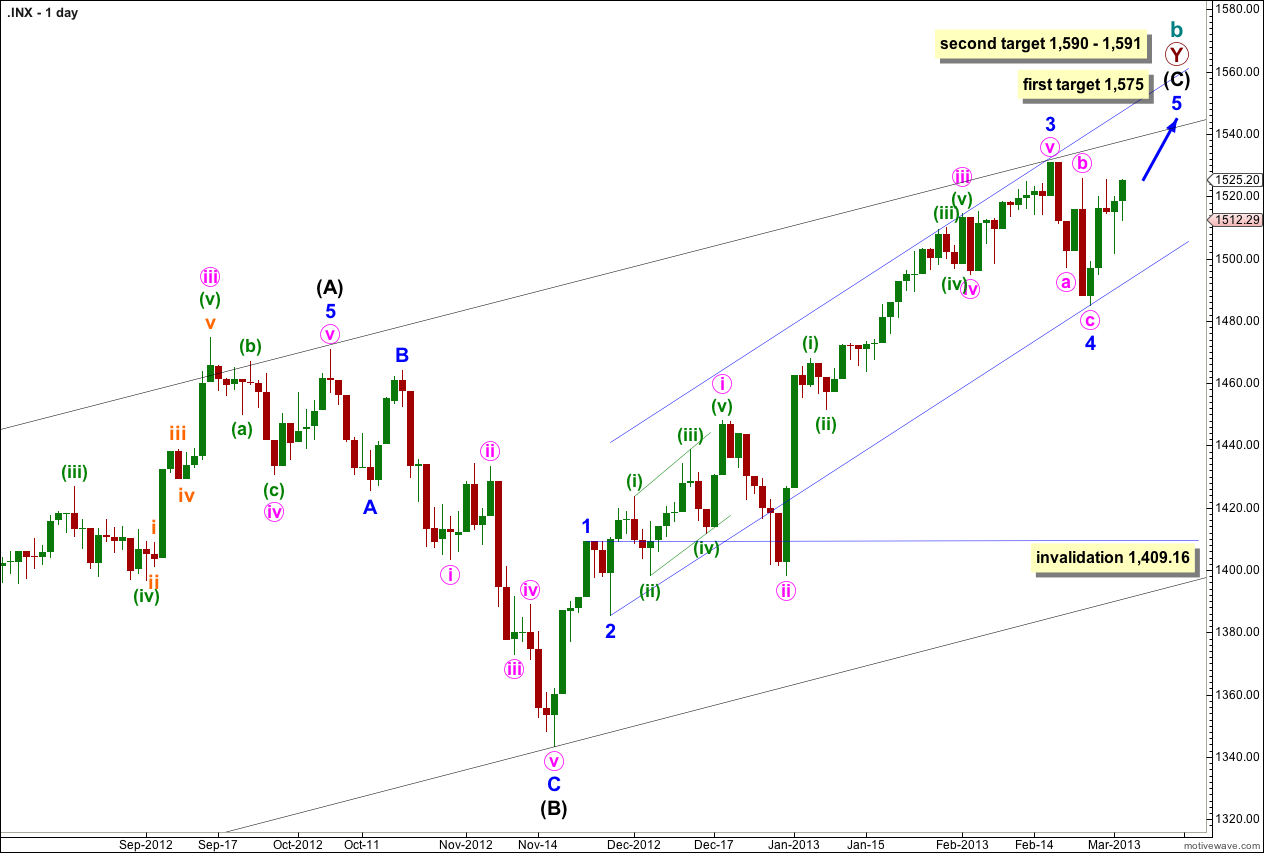

The structure is within the second zigzag of a double labeled primary wave Y. Within this second zigzag intermediate wave (C) is most likely incomplete.

Within intermediate wave (C) minor waves 1 through to 4 are most likely complete. We may use Elliott’s channeling technique to draw a channel about the impulse of intermediate wave (C). Draw the first trend line from the lows of minor waves 2 to 4, then place a parallel copy upon the high of minor wave 3. We may see minor wave 5 end mid way within the channel, or possibly about the upper edge.

I will continue also to draw the channel about the upper edge of primary wave Y: from the end of minor wave 4 within intermediate wave (A) to the low labeled intermediate wave (B), with a parallel copy upon the high of intermediate wave (A). This channel may continue to provide some resistance to upwards movement.

At 1,575 minor wave 5 would reach 0.618 the length of minor wave 3.

If price continues to move higher through the first target then we should expect the next likely target to be at 1,590 where intermediate wave (C) would reach 0.618 the length of intermediate wave (A). At 1,591 minor wave 5 would reach 1.618 the length of minor wave 1.

Within intermediate wave (C) minor wave 4 may not move into minor wave 1 price territory. This wave count is invalidated with movement below 1,409.16.

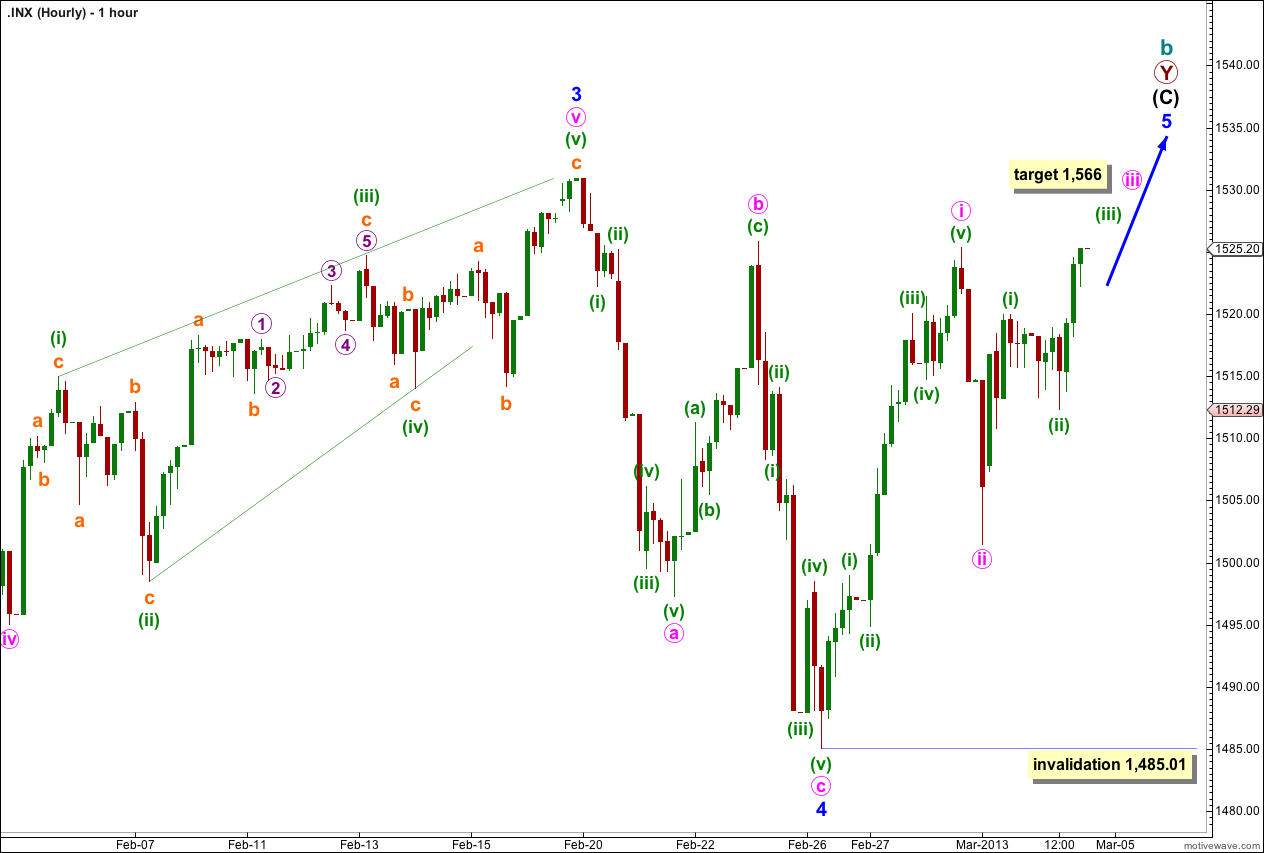

It is most likely that minor wave 4 is complete and minor wave 5 upwards is underway.

Within minor wave 5 minute wave i is complete. Minute wave ii is ambiguous on the 5 minute chart. If it was a three then minute wave ii may be over. If it was a five then it should continue a little lower. Minute wave ii may not move beyond the start of minute wave i. This wave count is invalidated with movement below 1,485.01.

At 1,566 minute wave iii would reach 1.618 the length of minute wave i. This target may still be a few sessions away.

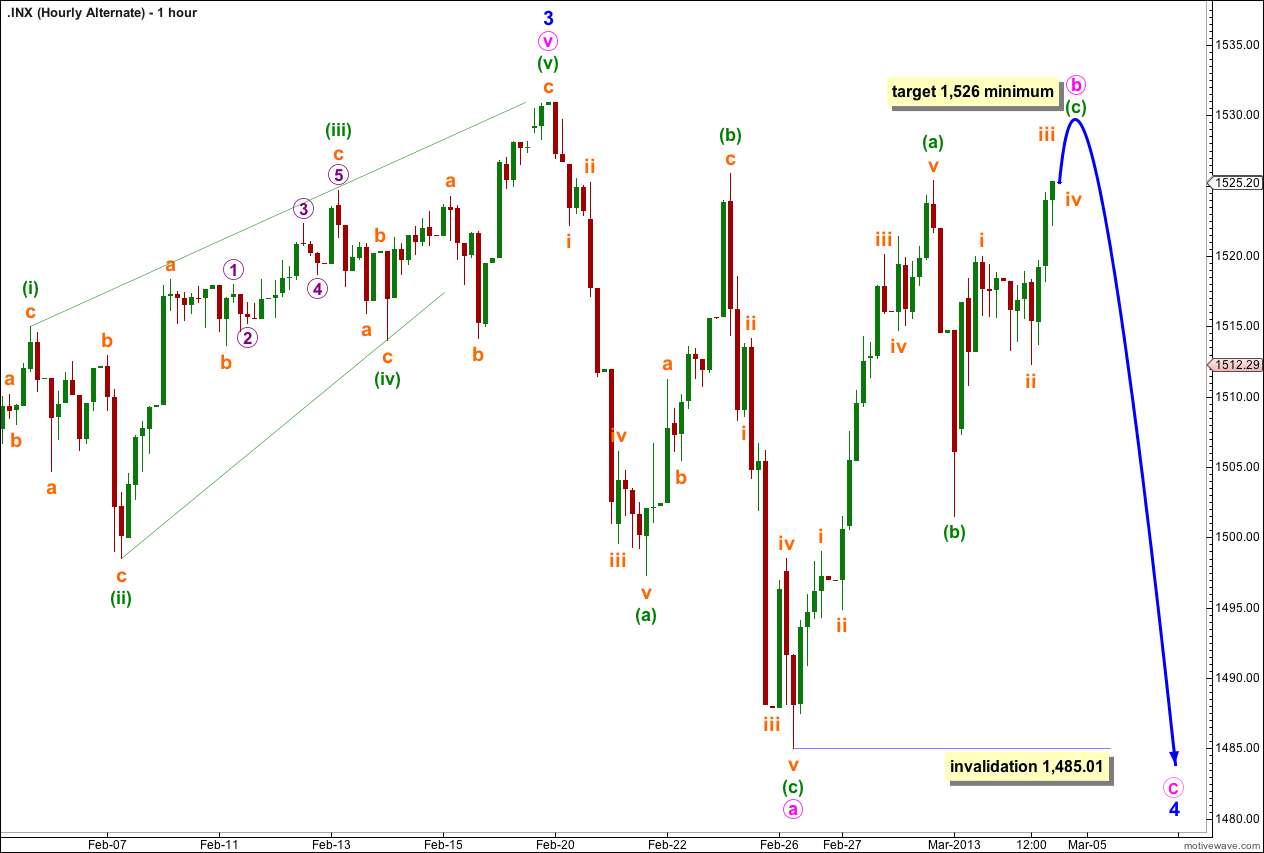

If we move the degree of labeling within minor wave 4 all down one degree then we may have seen only minute wave a within minor wave 4.

If minor wave 4 is an incomplete flat correction then minute wave b within it must reach to at least 90% the length of minute wave a. This requires a little more upwards movement to 1,526.

If minor wave 4 is an expanded flat correction then minute wave b must reach to 1,533 where it would be 105% the length of minute wave a.

When minute wave b upwards is a complete three wave structure then minute wave c downwards is extremely likely to make a new low below the end of minute wave a at 1,485.01.

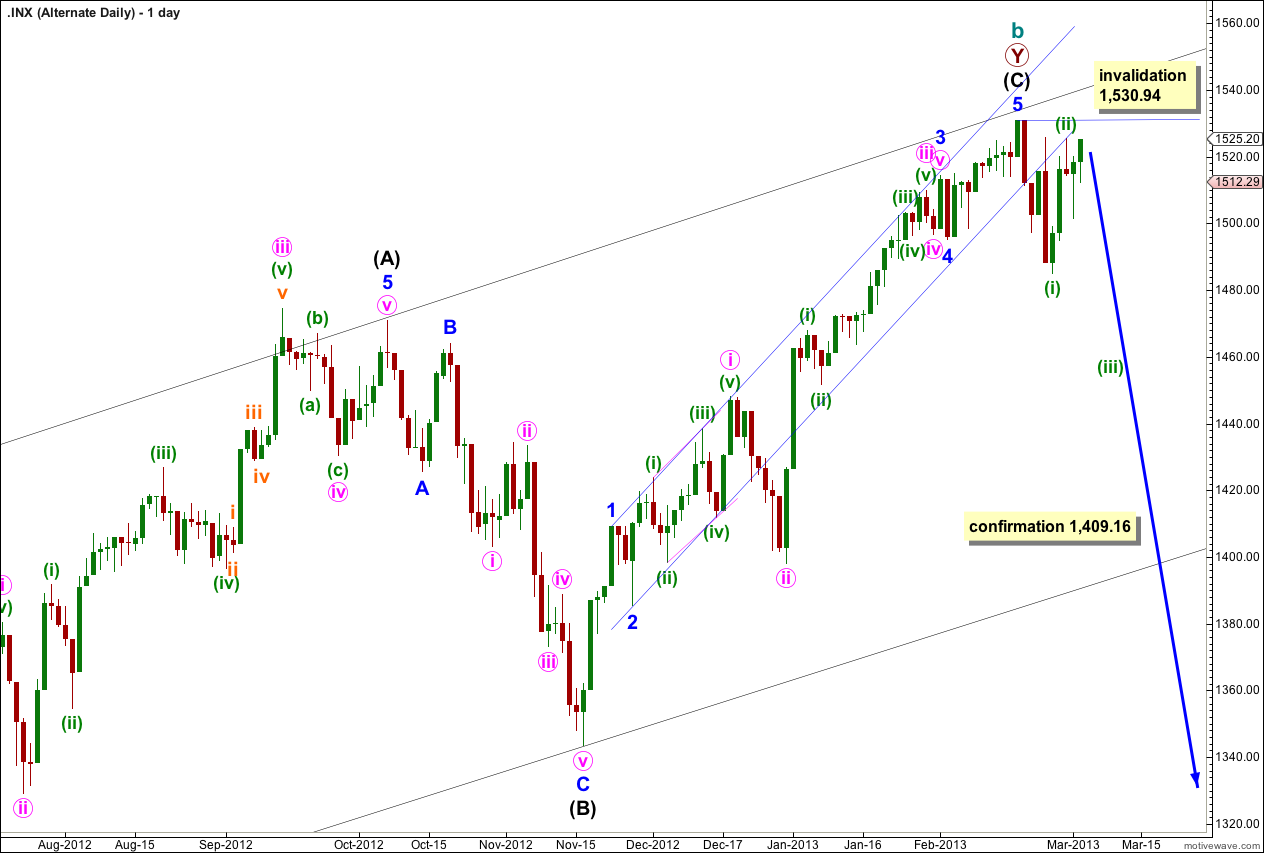

Alternate Daily Chart.

While price has not made a new high this alternate will remain viable.

If there has been a trend change then a leading diagonal may be unfolding in a first wave position.

Minuette wave (ii) may not move beyond the start of minuette wave (i). This wave count is invalidated with movement above 1,530.94.

A trend change would be confirmed with price movement below 1,409.16. At that stage the main wave count would be invalidated.