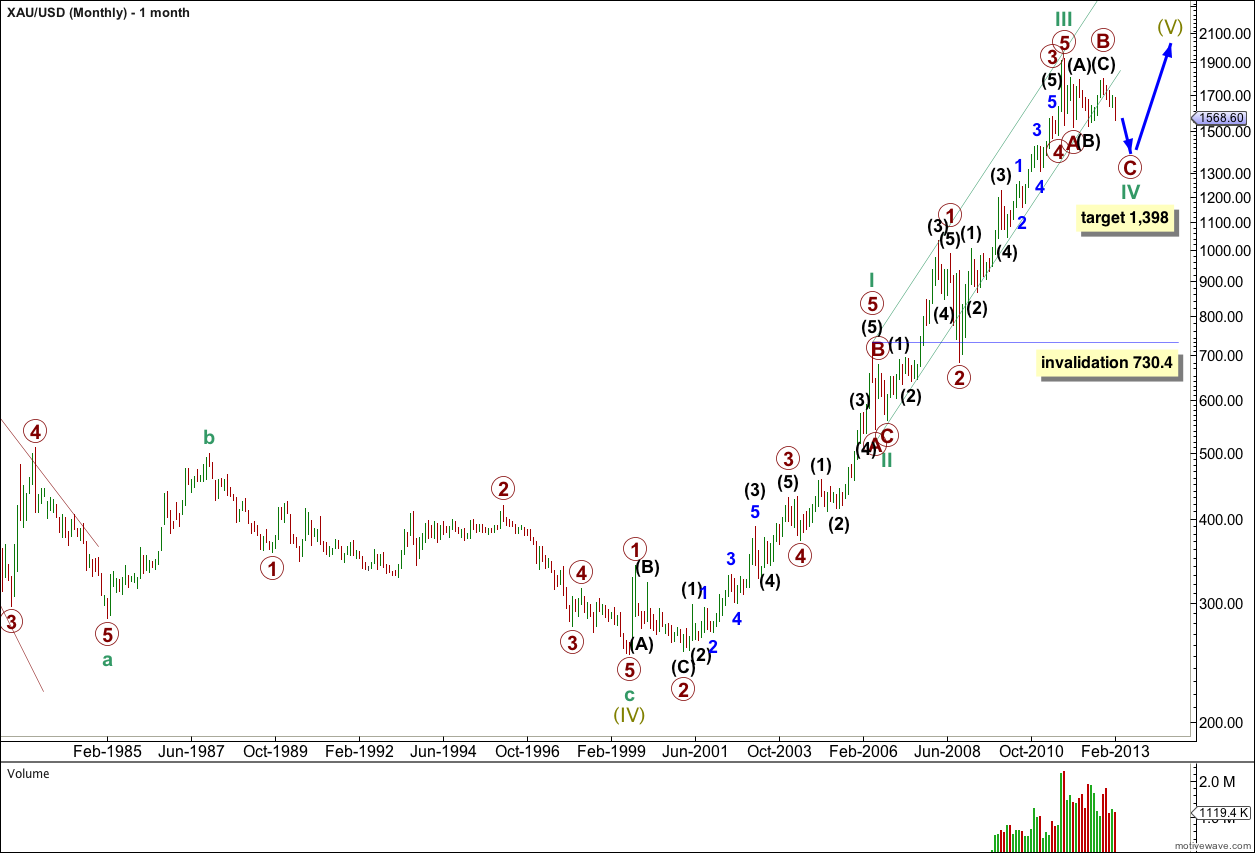

Last analysis of gold was on 25th January, 2012. That analysis expected a final upwards push to a target at 1,922 to 1,996. This did not happen and price has moved lower, although it has not breached the invalidation point on the weekly chart at 1,522.75.

I am reanalysing my monthly wave counts. I have a new monthly alternate, although the main wave count is the same and has a higher probability.

Click on the charts below to enlarge.

Historical Analysis.

Olive labels are super cycle and teal green labels are cycle. For a wave notation table go here.

There are some remarkably good fibonacci relationships in this analysis.

Within super cycle wave IV, cycle wave a ending Feb 1985 lasted 61 months. Cycle wave b ending Dec 1987 was a 38% correction of wave a and lasted a fibonacci 34 months. Cycle wave c has no Fibonacci ratio to cycle wave a and lasted 140 months, 4 short of a Fibonacci 144.

Within cycle wave c within super cycle wave IV ratios at primary degree are: primary wave 3 is just 2.35 short of equality with primary wave 1, and primary wave 5 has no Fibonacci ratio to primary wave 1. Regarding duration primary wave 1 lasted a Fibonacci 21 months, primary wave 3 has no Fibonacci duration nor does primary wave 5.

Within super cycle wave V cycle wave III is 109.16 longer than 2.618 the length of cycle wave I, an 8% variation (less than 10% is acceptable). Neither have a Fibonacci duration.

Ratios within cycle wave I of super cycle wave V are: primary wave 3 has no Fibonacci ratio to primary wave 1, and primary wave 5 is 16.35 short of 4.236 the length of primary wave 1. In terms of duration primary wave 1 lasted a Fibonacci 2 months, primary wave 2 has no Fibonacci duration, primary wave 3 lasted 35 months, one more than a Fibonacci 34, primary wave 4 has no Fibonacci duration, and primary wave 5 has no Fibonacci duration.

Within primary wave 2 of cycle wave I of super cycle wave V, intermediate wave (C) is just 2.15 longer than equality with intermediate wave (A). Intermediate wave (A) lasted a Fibonacci 2 months, as did intermediate wave (B), and intermediate wave (C) lasted one month short of a Fibonacci 13.

Ratios within primary wave 3 of cycle wave I of super cycle wave V are: intermediate wave (3) is 7.9 longer than 2.618 the length of intermediate wave (1), and intermediate wave (5) has no Fibonacci ratio to either of intermediate waves (1) or (3). In terms of duration intermediate waves (1) and (2) both lasted a Fibonacci 3 months, there is no Fibonacci duration for intermediate wave (3), intermediate wave (4) lasted a Fibonacci 5 months and there is no Fibonacci duration for intermediate wave (5).

Ratios within intermediate wave (3) of primary wave 3 of cycle wave I of super cycle wave V are: minor wave 3 has no Fibonacci ratio to minor wave 1, and minor wave 5 is 5.52 short of 1.618 the length of minor wave 1.

Ratios within primary wave 5 of cycle wave I of super cycle wave V are: there are no Fibonacci ratios between intermediate waves (1), (3) and (5). In terms of duration intermediate waves (4) and (5) both lasted a Fibonacci 2 months.

Ratios within cycle wave III of super cycle wave V are: primary wave 3 has no Fibonacci ratio to primary wave 1, and primary wave 5 is 14.26 longer than equality with primary wave 1 (a 3.2% variation). In terms of duration primary wave 1 lasted a Fibonacci 21 months, primary wave 2 a Fibonacci 3 months, primary wave 3 has no Fibonacci duration, and primary waves 4 and 5 both lasted a Fibonacci 2 months.

Ratios within primary wave 1 of cycle wave III of super cycle wave V are: intermediate wave (3) has no Fibonacci ratio to intermediate wave (1), and intermediate wave (5) is 12.56 longer than equality with intermediate wave (1) and is also 8.4 short of 0.382 the length of intermediate wave (3). In terms of duration only intermediate waves (4) and (5) have a Fibonacci duration, both lasted 2 months.

Ratios within primary wave 3 of cycle wave III of super cycle wave V are: intermediate wave (3) has no Fibonacci ratio to intermediate wave (1), and intermediate wave (5) is just 8.29 longer than 1.618 the length of intermediate wave (1). In terms of duration intermediate wave (1) has no Fibonacci duration, intermediate wave (2) lasted a Fibonacci 2 months, intermediate wave (3) lasted a Fibonacci 8 months, intermediate wave (4) lasted a Fibonacci 2 months, and intermediate wave (5) has no Fibonacci duration.

Ratios within intermediate wave (5) of primary wave 3 of cycle wave III of super cycle wave V are: minor wave 3 has no Fibonacci ratio to minor wave 1, and minor wave 5 is just 5.61 short of equality with minor wave 3.

Within cycle wave IV of super cycle wave V primary wave A lasted a Fibonacci 3 months. Primary wave B has no Fibonacci duration. Within primary wave B intermediate wave (C) is just 0.9 longer than equality with intermediate wave (A), while intermediate wave (A) lasted a Fibonacci 2 months, intermediate wave (B) lasted a Fibonacci 3 months and intermediate wave (C) lasted a Fibonacci 5 months (a perfect Fibonacci sequence). This zigzag is the most perfect I have ever seen.

Within cycle wave IV primary wave C would reach equality with primary wave A at 1,398. Cycle wave IV may not move into cycle wave I price territory. This wave count would be invalidated at cycle degree with movement below 730.4.

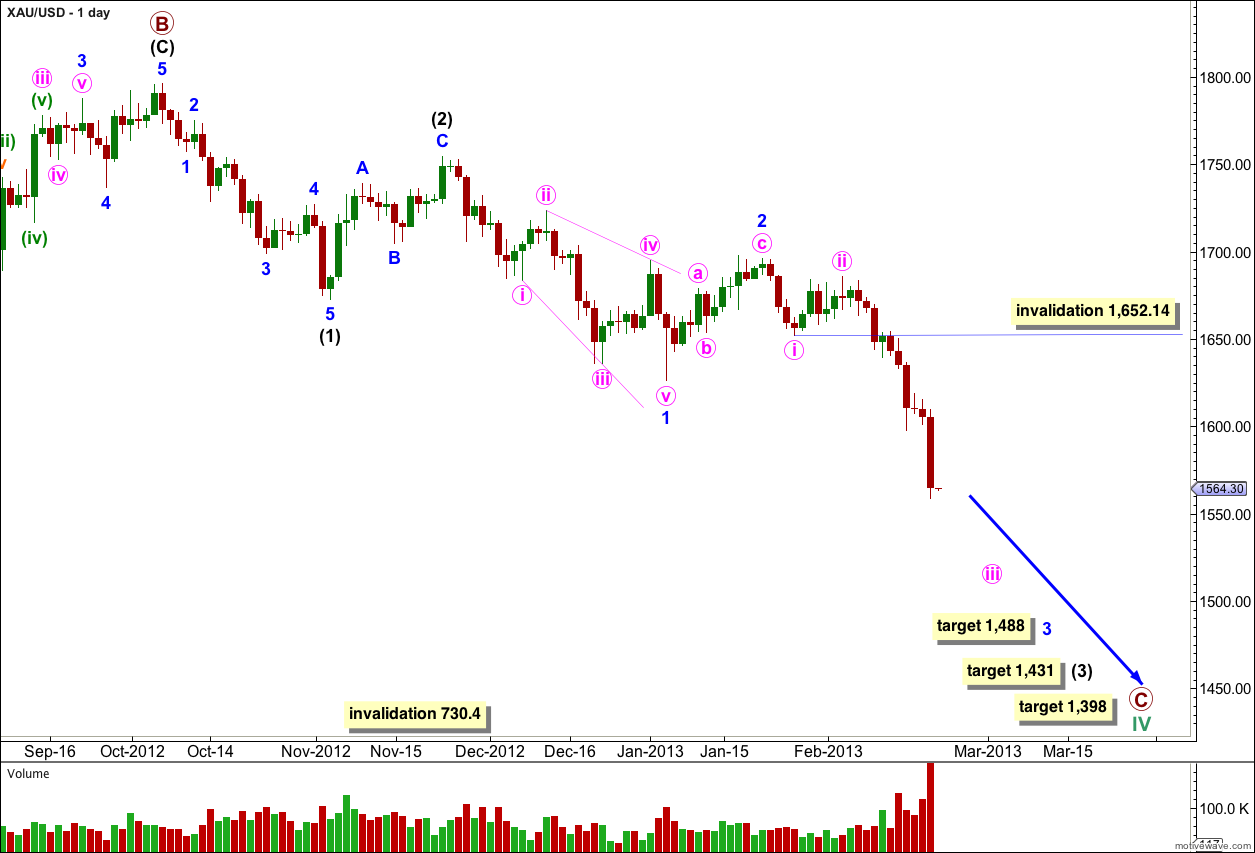

This daily chart focuses on the new downwards trend of primary wave C.

Within primary wave C intermediate waves (1) and (2) are complete. Intermediate wave (3) has begun. Within intermediate wave (3) price may have today moved into the middle of it. Minor wave 1 was a leading diagonal, minor wave 2 zigzag was a 55% correction of minor wave 1.

Within the zigzags of intermediate wave (2) and minor wave 2 there are no Fibonacci ratios between the A and C waves.

At 1,488 minor wave 3 would reach 1.618 the length of minor wave 1.

At 1,431 intermediate wave (3) would reach 2.618 the length of intermediate wave (1).

At this stage when minute wave iii is completed the following minute wave iv may not move into minute wave i price territory. This daily wave count is invalidated at minute degree with movement above 1,652.14.

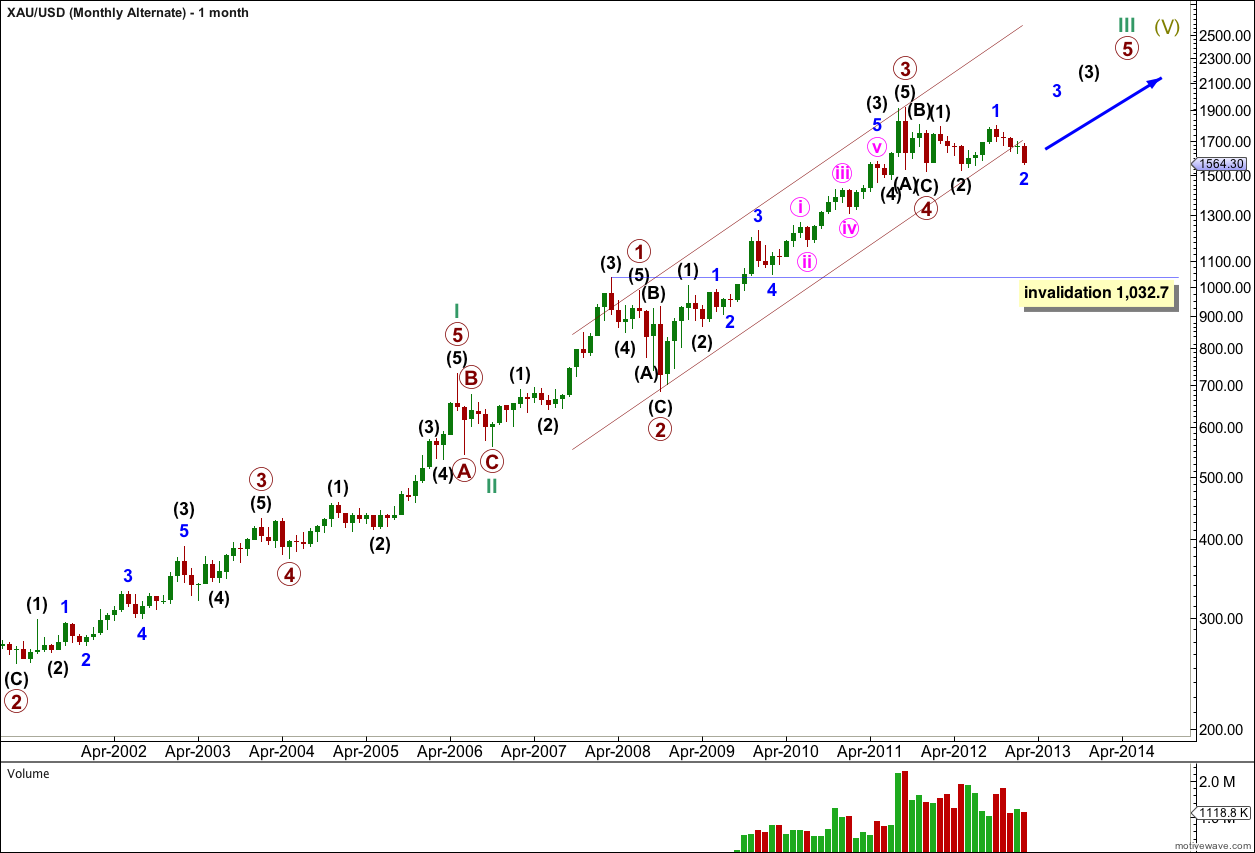

Alternate Monthly Wave Count.

This monthly wave count does not have a good a look as the main monthly wave count, but I am considering it because the subdivisons within primary wave 3 are a slightly better fit than the main wave count.

This current correction looks too large in duration to be a series of overlapping first and second waves; particularly minor waves 1 and 2 look too large. However, it is possible.

Ratios are the same as the main wave count up to the ends of cycle waves I and II. Thereafter, the wave count differs.

Within cycle wave III primary wave 3 is 116.61 longer than 2.618 the length of primary wave 1; not a good ratio but it is a 9.4% variation which is less than 10%. Primary wave 1 lasted a Fibonacci 21 months, primary wave 2 lasted a Fibonacci 2 months, primary wave 3 lasted one more than a Fibonacci 34 months, and primary wave 4 may be over in a Fibonacci 3 months.

Ratios within primary wave 3 are: intermediate wave (3) has no Fibonacci ratio to intermediate wave (1), and intermediate wave (5) is just 2.97 longer than 0.618 the length of intermediate wave (3). In terms of duration only intermediate waves (2), (4) and (5) may be considered to have a Fibonacci duration at 2 months each.

Ratios within intermediate wave (3) of primary wave 3 are: minor wave 3 has no Fibonacci ratio to minor wave 1, and minor wave 5 is just 2.58 longer than 4.236 the length of minor wave 1.

Ratios within minor wave 5 of intermediate wave (3) of primary wave 3 are: minute wave iii has no Fibonacci ratio to minute wave i, and minute wave v is 5.61 short of equality with minute wave iii.

If primary wave 4 is not over and extends lower it may not move into primary wave 1 price territory. This alternate is invalidated at primary wave degree with movement below 1,032.7.

The other reason why I do not prefer this alternate is it is not conforming to a trend channel. If cycle wave III is not over we have an unusual breach of the channel drawn using Elliott’s second technique. This does not have the right look at all.

Wow this is great! Thanks Lara!