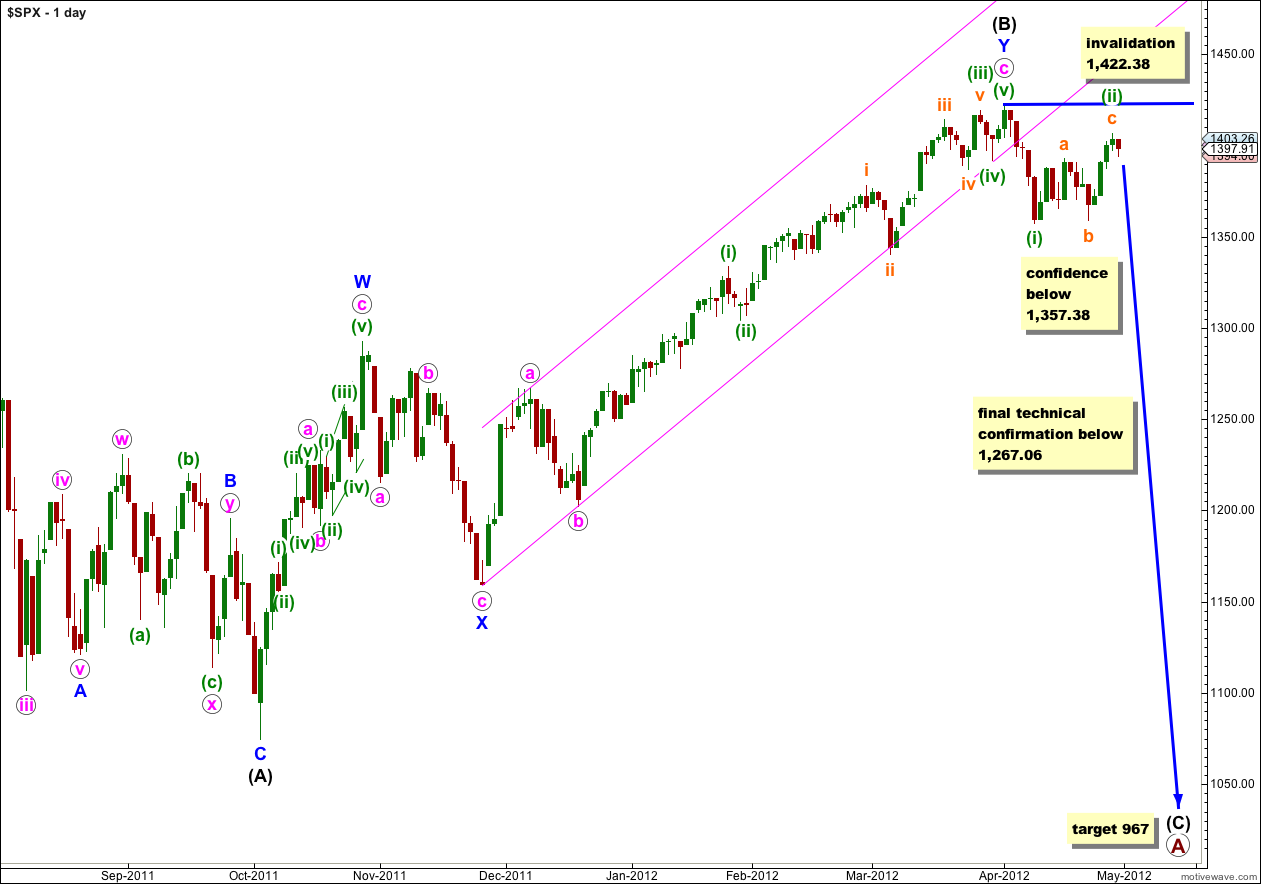

As expected from last analysis the S&P 500 has moved lower today. If my main wave count is correct the mid term target may be reached by the end of this week or next.

When price moves below the invalidation point for the alternate daily wave count then we may have significant increased confidence in the main wave count. This price point is an important differentiator.

Click on the charts below to enlarge.

Wave (i) green lasted a Fibonacci 5 days. Wave (ii) green has now lasted a Fibonacci 13 days. Within wave (ii) green this structure looks like a typical complete flat correction.

Movement below 1,357.38 would invalidate the alternate wave count at minuette degree and provide some confirmation for this wave count. At that stage I would discard the alternate and use only this one main wave count.

This wave count has a higher probability because the subdivisions fit much better, particularly within wave W blue of wave (B) black. It is much easier to see wave W blue as a zigzag than an impulse. Also, within recent movement this wave count has a much better fit on the hourly chart.

If this wave count is correct then wave (C) black downwards of an expanded flat correction for primary wave A has begun. At 967 wave (C) black would reach 1.618 the length of wave (A) black, which is typical for an expanded flat.

Wave (ii) green may not move beyond the start of wave (i) green. This wave count is invalidated with movement above 1,422.38.

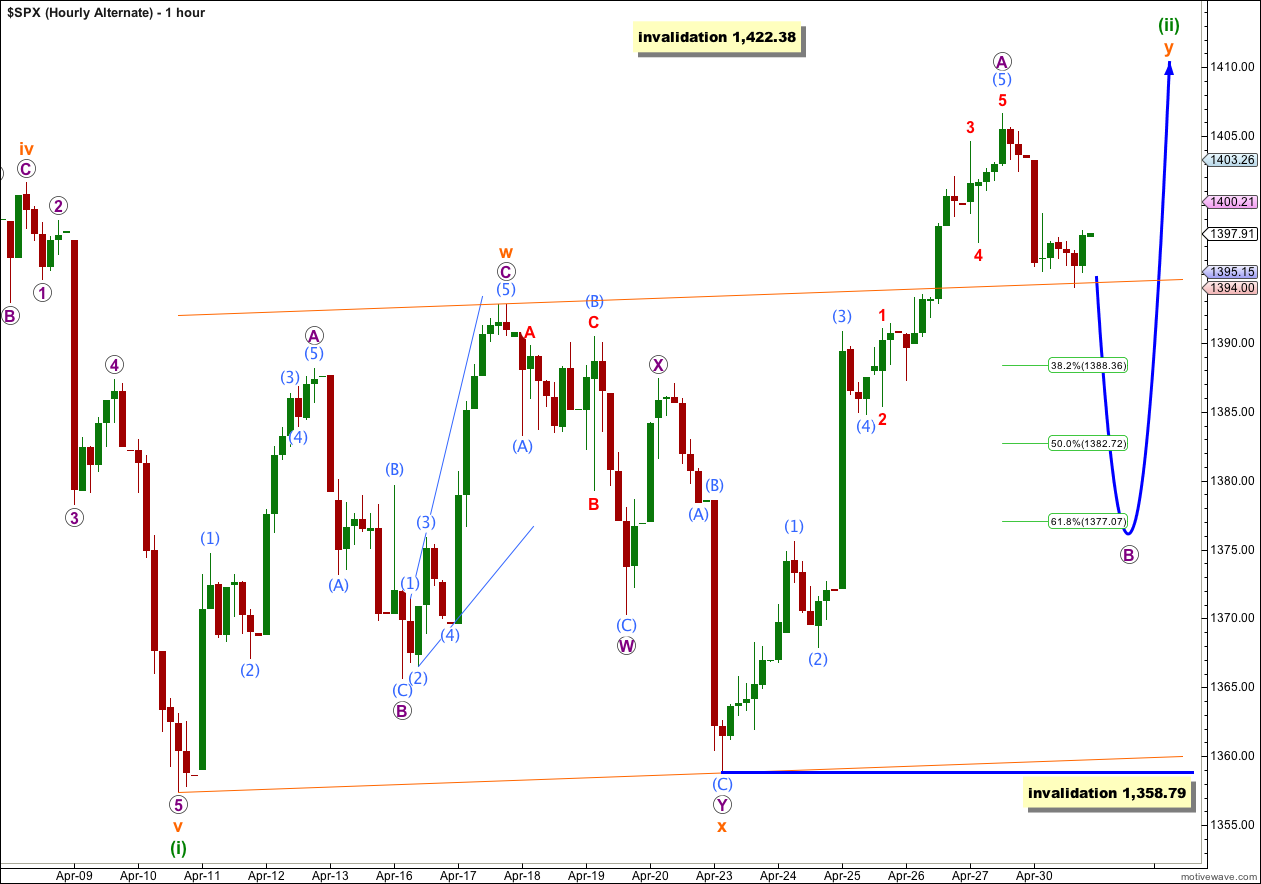

Main Hourly Wave Count.

Price has moved lower breaching the smaller narrow parallel channel containing wave c orange, and finding support at the upper edge of the parallel channel containing wave (ii) green. If this wave count is correct then tomorrow price should break through this support line and move lower with increasing downwards momentum.

At 1,301 wave (iii) green would reach 1.618 the length of wave (i) green. As more of this third wave unfolds I will use Fibonacci ratios within it to refine this target, so it will probably change.

Within wave (iii) green no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement above 1,406.64. If this wave count is invalidated with upwards movement then we shall use the alternate below.

Alternate Hourly Wave Count.

This wave count remains valid, but it has a very low probability.

This wave count is unlikely because wave (ii) green is already more than twice as long in duration than wave (i) green. Also, the purpose of a double zigzag is to deepen a correction when the first zigzag does not move deep enough. This correction is already over 90% of wave (i) green and with almost no further room for upwards movement this correction does not need to be deepened.

Wave (ii) green could possibly be unfolding as a double zigzag structure. Within the double the second zigzag labeled y orange would be incomplete.

Within wave y orange wave B purple may not move beyond the start of wave A purple. This wave count is invalidated with movement below 1,358.79. If price moves below this point our main hourly wave count would significantly increase in probability.

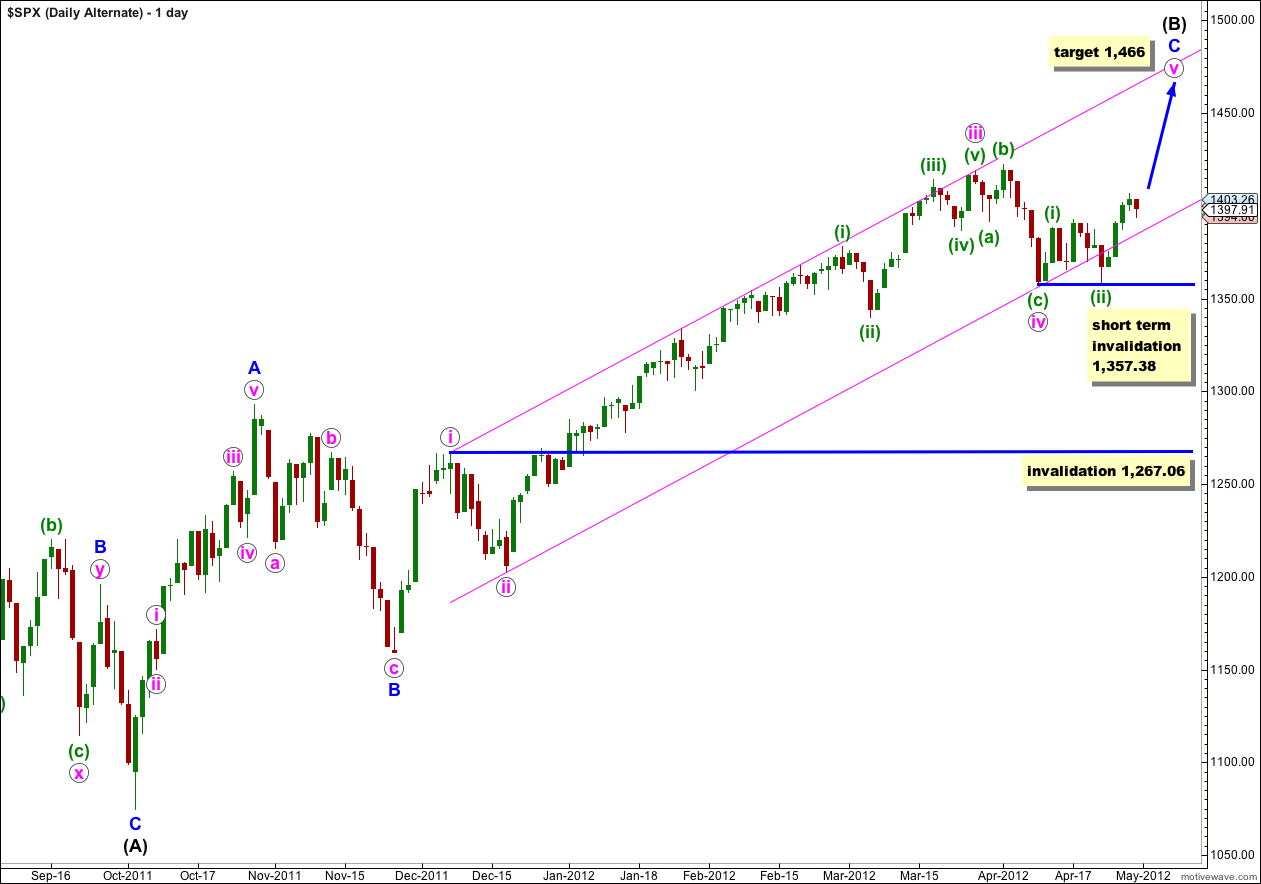

Alternate Daily Wave Count.

This wave count remains valid but still has a lower probabilty than the main wave count for three main reasons:

1. On the daily chart the subdivisions within wave A blue of wave (B) black do not fit well at all. Wave iii pink does not look right.

2. On the hourly chart what would be wave c orange within a flat for wave (ii) green cannot be seen to subdivide into a five wave structure.

3. There is now a small trend channel breach. Although sometimes fourth waves don’t fit nicely into trend channels, because here wave iv pink is a nicely completed structure, this channel breach does not look right.

If wave (B) black is a single zigzag then wave C blue within it is incomplete. At 1,466 wave v pink would reach equality with wave i pink.

Movement below 1,357.38 would invalidate this wave count as wave (ii) green may not move beyond the start of wave (i) green.

I see big bearish divergence on the McClellan Oscillator (NYMO) (44.61 down to 36.30) any push high should be sold.

I like the close under last Friday’s high better … 🙂

Lara,

It seems to me that the alternate daily count should now be the main count with today’s strong move up. Will you begin to provide an hourly wave count for this alternate.

Thanks,

Peter

I agree Peter. I’m going to use the alternate as the main wave count now. The Dow also moved up strongly and invalidated its main wave count, I expect the S&P 500 will follow soon.