Elliott Wave chart analysis for Gold for 24th May, 2011. Please click on the charts below to enlarge.

This analysis of Gold includes an historical count.

I have noticed some amazing fibonacci ratios between waves for gold. This means that when I can get this market right I may be able to produce some very accurate predictions. I expect it may take me a couple of months or so to get a “feel” for how gold behaves. To that end I intend to analyse this market regularly, as I want to trade it myself.

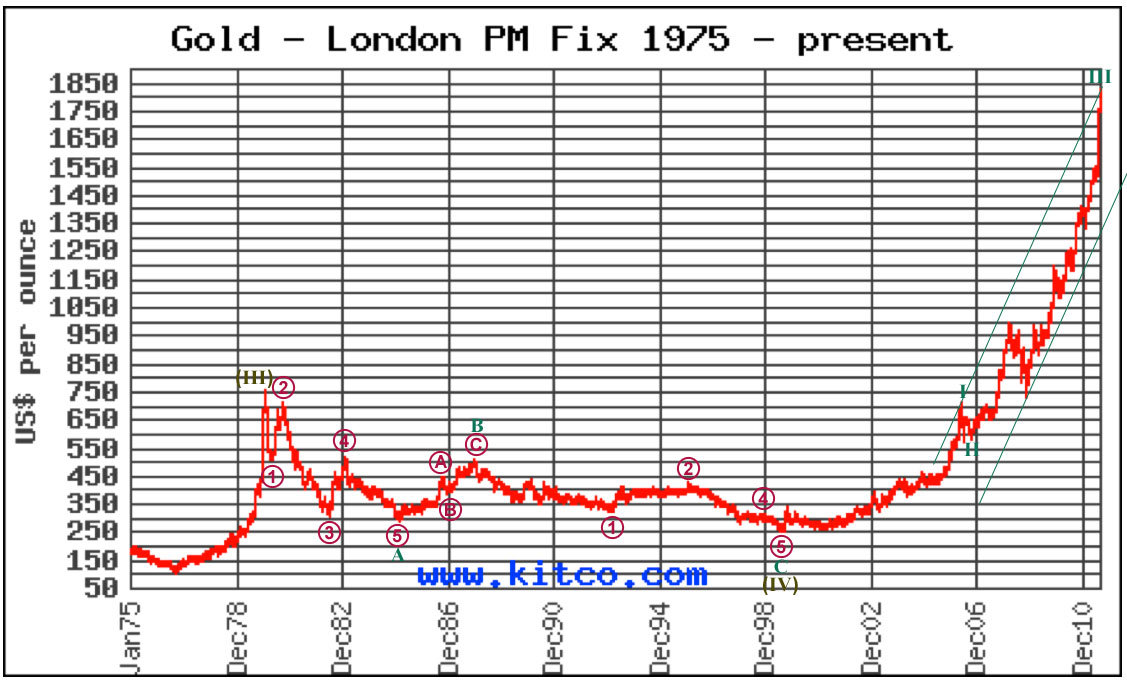

Historical Chart.

Olive labels are super cycle and teal green labels are cycle. For a wave notation table go here.

There are some remarkably good fibonacci relationships in this analysis.

Cycle wave A ending Feb 1985 lasted a fibonacci 54 months. Cycle wave B ending Dec 1987 was a 50% correction of wave A and lasted a fibonacci 34 months. Cycle wave C is 234.61 in length and is just 3.16 longer than 0.618 the length of cycle A, and lasted 141 months, just 3 short of a fibonacci 144.

Within cycle degree wave 1 ratios between primary (maroon) waves are: primary 3 has no fibonacci ratio to primary 1 and primary 5 is just 10.6 short of 4.236 the length of primary wave 1.

Primary 1 lasted a fibonacci 2 months. Primary wave 3 lasted 35 months, one month longer than a fibonacci 34. Primary wave 5 lasted 24 months and is not close enough to 21 for a fibonacci relationship.

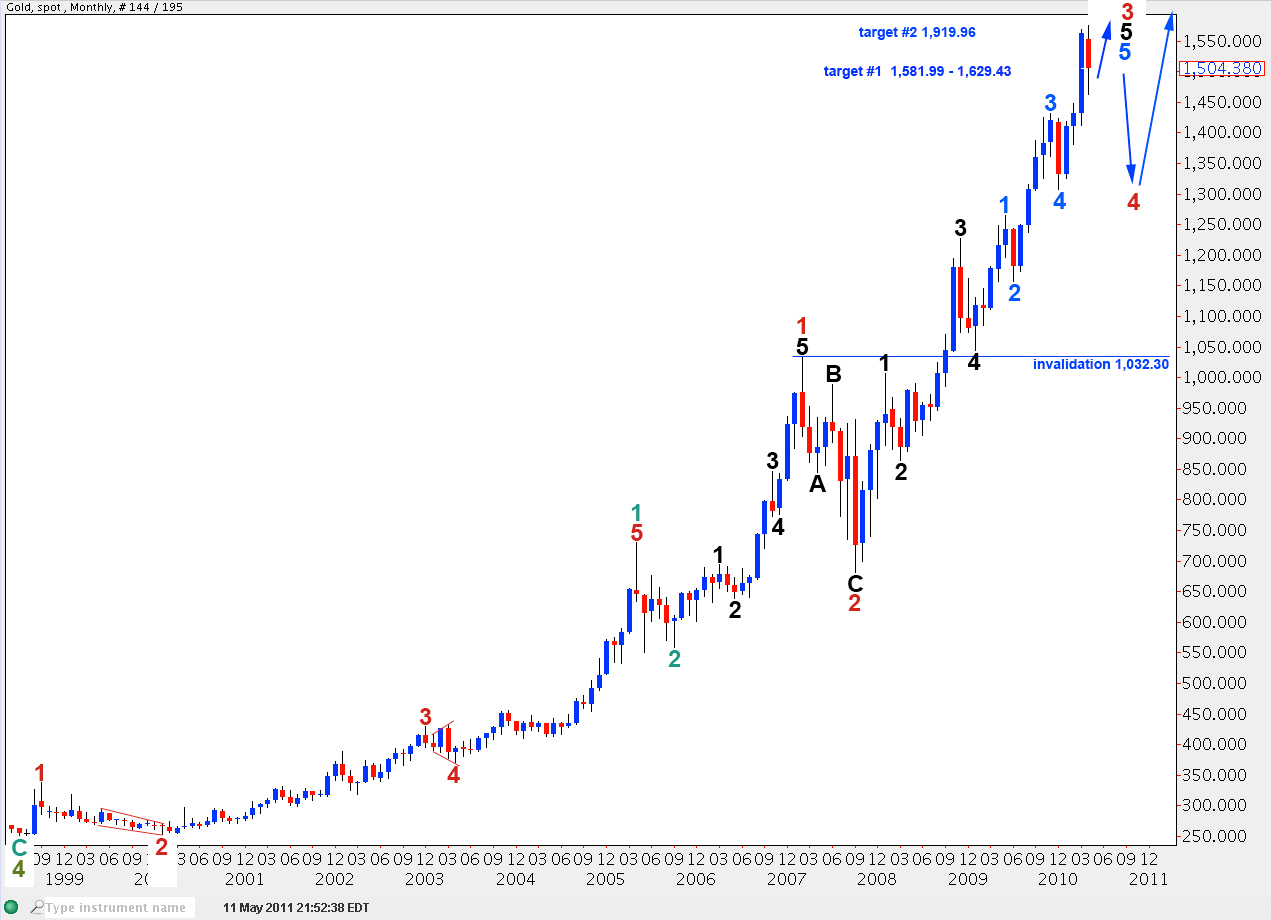

Within cycle wave 3 primary wave 1 was 473 long and lasted 17 months. If primary wave 3 is 2.618 the length of wave 1 price will rise to 1,919.96. This is a second target for primary 3 to end.

Within primary wave 3 ratios between intermediate (black) waves are: wave 3 black has no fibonacci ratio to wave 1 black. If wave 5 black reaches 1.618 the length of wave 1 black price would rise to 1,629.43. This is the first target for primary wave 3 to end.

Within blue wave 5 upwards of black wave 5 to end primary wave 3, this wave count sees gold within a minute (pink) fourth wave correction.

Wave 4 pink is unfolding as a zigzag.

When it is complete then gold will be due to make new highs (most likely) in a final fifth wave upwards to end primary wave 3.

At 1,629.43 intermediate (black) wave 5 will reach 1.618 the length of black wave 3.

This 4 hourly chart shows the whole correction to date for wave 4 pink.

Ratios within wave A green are: wave 3 orange is 3.78 short of equality with wave 1 orange and wave 5 orange is 0.92 short of 0.618 the length of wave 3 orange.

Ratios within wave 3 orange of wave A green are: wave 3 purple is 1.76 short of 1.618 the length of wave 1 purple and wave 5 purple is 1.5 short of equality with wave 1 purple.

Within wave B green wave B orange is an 86% correction of wave A green. Wave B green is labeled here as a rare triple zigzag. Although this is a rare structure the subdivisions all fit perfectly and after considering different possibilities this is the best fit I can see.

Within wave A orange of wave B green there are no adequate fibonacci ratios at purple degree. This makes me wonder if this labeling for this piece of movement is incorrect as all other waves exhibit remarkable fibonacci ratios.

Ratios within wave 3 purple of wave A orange of wave B green are: wave 3 aqua has no adequate ratio to wave 1 aqua and wave 5 aqua is perfectly equal to 0.618 the length of wave 1 aqua.

Within wave B orange triple zigzag wave W purple: wave C aqua is just 0.89 short of equality with wave A aqua.

Within wave X purple: wave C aqua is just 0.49 longer than 0.618 the length of wave A aqua.

Within the second wave X purple: wave C aqua is just 0.48 longer than equality with wave A aqua.

Within wave Z purple: wave C aqua is just 0.64 longer than 1.618 the length of wave A aqua.

Within wave C orange to end wave B green wave 3 purple is 2.54 longer than equality with wave 1 purple.

Ratios within wave 3 purple of wave C orange of wave B green are: wave 3 aqua is just 0.35 short of 1.618 the length of wave 1 aqua and wave 5 aqua is just 0.48 longer than 0.382 the length of wave 1 aqua.

At 1,532.09 wave 5 purple within wave C orange will reach equality with wave 1 purple.

At 1,535.98 wave C orange will reach equality with wave A orange.

This is a reasonable target for this upwards trend to end.

Thereafter, a five wave structure downwards for wave C green would end wave 4 pink zigzag.

I have seen a few truncations while analysing gold but they do not seem to be overly common. Therefore, I would expect coming downwards movement for wave C green to most likely not be truncated and so take price below 1,462.27, the end of wave A green.

Wave 4 pink may not move into wave 1 pink price territory. This wave count is invalidated with movement below 1,444.60.

Wave B green may not move beyond the start of wave A green. This wave count is invalidated with movement above 1,575.41.